Carclo PLC

Technology

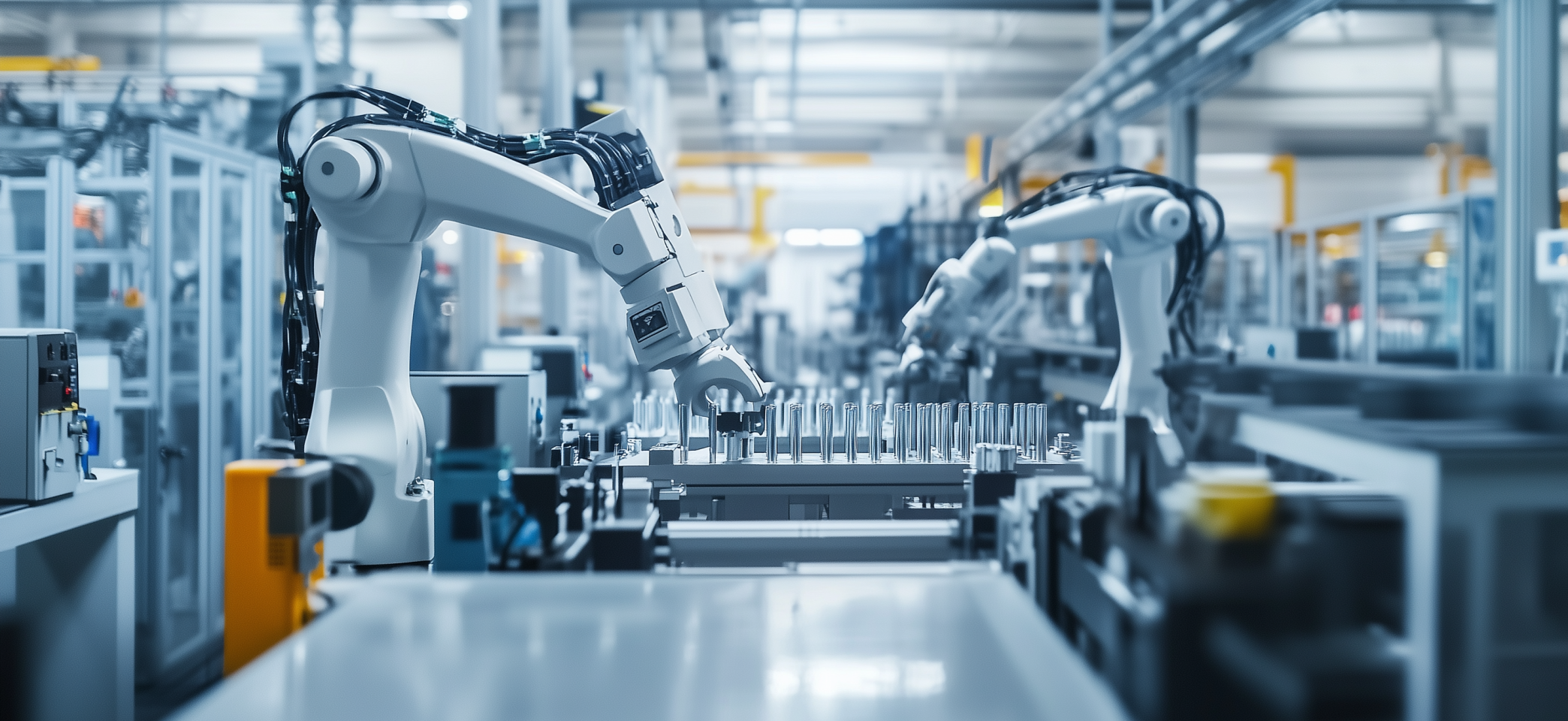

Validated precision at scale

End-to-end capability from design and tooling to automated, qualified production in-region

ROS delivered 10%

Trust

Assurance you can audit

Regulated quality, full traceability and disciplined execution across Life Sciences and Aerospace.

ROCE hit 25%.

Transformation

Margin before volume

Portfolio simplified, capital and capacity focused on high-return lines

Net debt 1.4× (from 1.2× FY25).